Hotel Break-even Analysis Template

Running a hotel business carries plenty of risks. With the constant flow of income and expenses, it can be hard to tell whether the establishment is making a profit or suffering from losses.

One very effective way to reduce risks when starting a business is by doing a break-even analysis. As with most businesses, you need to determine that specific point or magic number, both in terms of guestrooms sold and revenue generated, where the hotel will start to realize a profit.

What is Break-even Analysis and Why is It Important for Hotel Businesses?

The primary objective of any business is to make a profit. But before you can start profiting, you need to break-even first.

The break-even point (BEP) is the point where your business’s total revenue is equal to its total expenses. This means that when your business is “breaking even,” it’s neither making a profit nor losing money. You will only start generating profit once your revenue goes beyond the BEP.

Doing a break-even analysis is a must before starting a hotel business, or any business for that matter.

Reasons to Perform Break-even Analysis:

- It gives you an idea of how many units you need to sell to cover your operating cost.

- It helps you establish a baseline of sales volume or revenue that you need to meet and exceed for a specific period.

- It helps you decide if your business idea is viable.

- It makes you more realistic about costs and pricing strategy.

The Hotel Break-even Analysis Template for Excel

Break-even Analysis involves plenty of formulas, which can get very confusing if you’re not familiar with the process. Using a break-even analysis template will make things much simpler.

The Hotel Break-even Analysis Template calculates your break-even point (BEP) in two ways:

- In terms of physical units sold/rooms occupied during the period

- In terms of sales and revenue

However, before you can start using the template, you need to gather the following information about your business operations:

Fixed Costs

Fixed costs are business and operational expenses that stay the same from month to month, and do not fluctuate based on occupancy.

Typical fixed costs may include employee payroll and benefits, mortgage and insurance payments, and property taxes.

Variable Costs

Variable costs are expenses that change depending on the occupancy rate of the hotel and use of its amenities.

The most common variable costs are for utilities and repair expenses.

Mixed Costs

Mixed costs are expenses that can be both fixed and variable.

Labor expenses are a common example of mixed costs, because while salaries are fixed and predictable, hourly wages can change depending on the hours of work rendered and overtime.

Average Selling Price

The average selling price of the hotel’s guest rooms is an important factor in calculating the break-even point, both in terms of units/rooms sold and target income.

The minimum selling price for a guestroom should be at or above its variable cost.

About the Template

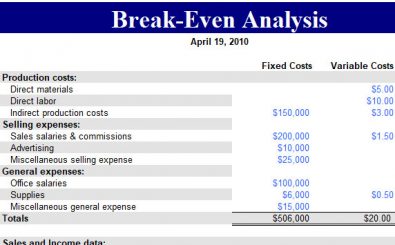

The Hotel Break-even Analysis worksheet is divided into three sections.

- Expenses

The Expenses section is where you input both the fixed and variable costs of operating the hotel such as:

Production costs

Selling expenses

General expenses

The template will automatically calculate your fixed costs and variable costs based on the data you entered.

You can edit the data points to reflect your business operating expenses. - Sales and Income Data

The Sales and Income Data is based on your projected or expected sales/room occupancy and target income for the period. - Results

The Results section displays how many units you need to sell (Unit Sales at Break-even Point) and how much money you need to make (Dollar Sales at Break-even Point) to break even.

In addition to the Break-even Point (BEP), the template also solves for the following values:

Contribution Margin per Unit

Dollar Sales at Expected Level

Expected Operating Income

Unit Sales at Target Operating Income

Dollar Sales at Target Operating Income

How to Use

Overall, the Hotel Break-even Analysis Template is very easy to use and understand. All you have to do is input the required data, and the worksheet will perform the calculations for you.

Here’s very simple step-by-step guide to using the Hotel Break-even Analysis Template:

- Gather Your Data. This includes your Fixed Costs, Variable Costs, Mixed Costs, and Average Price,

- Plug in Your Data. Fill in the Expenses section according to type of cost – fixed, variable, or mixed. If a specific expense is a mixed-cost, calculate how much of it is fixed and how much is variable, and enter the data on their respective columns.

Do the same for the Sales & Income Data section. The Selling Price per Unit should reflect the average price of your items or cost of your rooms. - Adjust Your Numbers. This is an analysis tool, so feel free to experiment with numbers. Adjust your fixed and variable costs or even your selling price per unit to test different pricing strategies and business scenarios.

Like many forecasting metrics, the Hotel Break-even Analysis template has its limitations. However, it can be a powerful and straightforward tool that small and average-sized hotels can use to improve their profitability.

DOWNLOAD