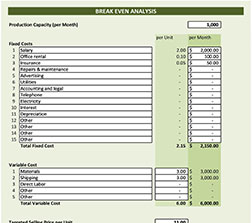

Simple Break Even Analysis Template

Starting a business requires taking risks. While there is no way to avoid the risks, there is a way for you to keep the risks to a minimum by doing a break-even analysis. If you are running a business or considering starting one, knowing how to do a break-even analysis is deemed a must.

What is Break-Even Analysis?

A break-even analysis is a tool you can use to determine at what point your business will be profitable. In other words, it is a financial calculation that’s used to determine what you need to sell to cover your costs.

If you are breaking even, you are not losing money, but you are not making money either. However, all your costs are covered. Don’t know how to do a break-even analysis? Using a simple break-even analysis template is an excellent place to start.

When is Using a Break-Even Analysis Ideal?

Doing a break-even analysis can be beneficial in the following scenarios:

When starting a new business

As mentioned earlier, creating a break-even analysis is crucial when you’re starting a new business. Doing a break-even analysis will not only help you gauge if your business idea is viable, but it can also help you create a better pricing strategy.

Changing your business model

If you would like to change your business model (i.e., from carrying inventory to drop-shipping), a break-even analysis can be very beneficial. Keep in mind that your cost can change dramatically, so you need to figure out if your prices have to change as well.

Adding another sales channel

Often, if you add a new sales channel, the cost can change even if your prices won’t. Case in point: let’s say you have been selling online, and you’re considering opening a pop-up shop. You need to make sure you break-even before implementing the idea.

Another example will be if you add new online channels. For instance, if you’ll sell your products on Instagram, will you spend money to promote your channel? If so, the marketing cost should be included in your break-even analysis.

Creating a new product

Even if you are already running a thriving business, you still need to do a break-even analysis before introducing a new product. Doing a break-even analysis is especially important if the new product can add to your expense significantly.

What are the Benefits of Doing a Break-Even Analysis?

Doing a break-even analysis offers peerless benefits. Some of the most notable include:

You can price your products accordingly

If you want to price your products correctly, finding your break-even point is recommended. While some psychology is needed for effective pricing, knowing how it can affect your profitability is just as important.

You can anticipate all the expenses

It’s possible for some expenses to slip through the cracks when you’re preoccupied with so many things related to the business. However, when you do a break-even analysis, you will be able to determine all the possible expenses so you can figure out your break-even point. If anything, the break-even analysis can also help limit any surprises down the road.

You can set revenue targets

Once you have completed a break-even analysis, you will know exactly how much you need to sell for your business to be profitable. A break-even analysis can also help ensure you can create concrete sales goals. When you have a definite number in mind, it’s easier for you to find ways to achieve it.

You can make smarter decisions

At times, entrepreneurs make decisions based on emotions alone. For instance, if they feel good about a new venture, they often go for it. While making decisions based on a hunch will sometimes deliver excellent results, going with your gut feeling won’t usually suffice.

If you want your business to thrive, you also need to make decisions based on facts. That said, you can use your break-even data to come up with smarter decisions that can take your business to the next level.

You can fund your business

A break-even analysis is considered a crucial part of any business plan. If you want to invite investors, you might be required to show them your break-even analysis to prove your business plan is viable. Also, if your analysis is good, you will feel more confident about investing in your business.

You can limit your financial risks

A break-even analysis can help you avoid substantial financial risks by showing you if your business idea is worth investing in. Your break-even analysis can also help create a realistic picture of the possible outcomes of your business.

Considering all the benefits of doing a break-even analysis, it’s easy to see why it’s regarded as a must for every business.

DOWNLOAD