Financial Analysis

Introduction to Financial Analysis in Microsoft Excel

Microsoft Excel has been one of the leading applications adopted by all types of businesses for financial analysis. Its popularity can be traced to Microsoft Excel’s unique features.

Excel is a device that assists us in automating repetitive tasks and therefore shortens the time we waste on handling our spreadsheets. If you depend on this type of data, it seems necessary to learn the primary utilities of Excel for creating a financial analysis template.

How do you assess financial systems in Excel?

This kind of financial modeling forecast is a new business’s dream software. It’s surprisingly easy to use these features. Just type the number in the cell to the right syntax, and the automation will take place.

There are almost fifty Excel features for financial analysis. Some (LETRA.DE.TES) are unique and correspond with the US Treasury. Few tasks require all 50 specifications, so we’re listing the top 12 Excel business financial analysis template features in this article.

Top 12 Finance Analysis Features in Excel

1. ACCRINT: This recovers the interest earned by the value with interest costs.

2. NT.ACUM.V: should be applied when you choose interest payments to maturation.

2. AMORLINC: recovers the loss for each financial year.

3. AMORDEGRC: uses a decreased coefficient.

4. COUPDAYS: restores the total of days of the discount era, including the date of payment. It has many variants, such as CUPON.DIAS.L1, varying from the opening of the period to the date of payment or CUPON.DIAS.L2, from the day of payment to the incoming coupon date. COUPNUM (coupon compensation between the settlement date and due date) and CUPON.FECHA.L1 or L2 may be applied, which restores the coupon date before the actual settlement and the next coupon date following the second settlement.

5. PAYMENT Functions: while CUMIPMT shows the net interest paid for two dates, CUMPRINC returns the total capital invested on the debt for two terms.

6. TIR: yields the intrinsic return on investment on a collection of cash flows. Alternatively, for XIRR, we get a built-in rate of return on income without it needing to be regular.

7. VNA: recovers the net current value of the investment based on a sequence of quarterly cash flows and discount rates. Switch to XNPV to measure the current value without continuous cash flows.

8. RNDTO: For the annual rate of return of the portfolio that pays the regular interest while applying YIELDMAT.

9. YIELDDISC: estimates the annual rate, in turn using the market price return discount as the Treasury Note.

10. DVS: restores us to the depletion of the asset for a set period of or to the formula used to measure the decreased balance.

11. VA: Tells you exactly the present worth of the investment.

12. DB: It recovers the depletion of the asset for a set period through the process of amortization of the set balance. With the DDB feature, you get that asset amortization for a set period. However, the use of the amortization option to double the decreasing balance as explicitly stated.

Such features are more common when faced with Excel’s financial analysis template tasks. Whoever uses Excel features for a company financial analysis excel template ought to get acquainted with them. It’s a simple-to-use tool after we get used to it. Many users see Excel as a godsend in resolving ever-influential financial analysis.

Financial Templates in Excel emphasize the highs and lows associated with optimal project management. There are many applications to solve the problems of banks and financial institutions, but Excel has always been a top performer for most practitioners.

Significance of Financial Modeling

A financial model is a useful tool for corporate regulation. If well-developed, it can prove helpful to consider the production and delivery of your marketing plan. This supports simple cash flow preparation and develops a clear corporate value appraisal system.

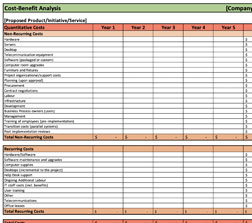

Business Financial Analysis Template

The substance of any reliable financial model provides you with answers to many of the questions businessmen must ask when assigning the necessary assets to complete a business model.

The Business Plan in Statistics

Financial model analysis offers a comprehensive outline of the campaign. Early data appears throughout this review as a series of core conclusions and causal interactions. There should be no question that it is relevant information.

Early Data for the Financial model

While designing the plan, we recommend starting from the source information of the first stage. The source information includes:

- Material costs,

- wages of workers,

- rental rates.

The outcome is an unbiased business model, stripped of any confusion and unclear statistics. In these Excel illustrations, details for the financial model displayed in a structured manner, are separated into categories of “investment-revenue-expenditures.” The system gives some idea of what the early data for the estimates are indicating.

Initial Details for the Financial System

For the ease of gathering data and organizing the financial model, Microsoft creates a type of automated data input. You can now use it to your advantage when accessing many of the 50 Excel utilities mentioned earlier.

Framework for Financial Systems

MS Excel is the classical software for the Creation of Financial Models. It develops the framework behind most of the financial system businesses use today. Excel is continuing to make major steps for the creation of financial models.

Modeling in this software offers several features that are only accessible in Excel, particularly in terms of strategic analysis. If you want to easily measure profitability or consumer products in high demand, you can use it effectively.

The Complexity of the Financial Model

Financial models are not just about sheer numbers; they are mostly about interactions. A good financial model analyzes the connections, expectations, and circumstances that together establish the future viability of the business idea.

When you consider linkages, big profit generators, costs, resources, and other critical indicators, you recognize the root of a modeled company’s success. In some situations, the application of excel is required for many banks, which call for financial analyses of many operations. This criterion is linked to an ability to check the outcomes of the estimates separately through the study of the business plan. Yet we choose a financial model for project specialists. This sort of modeling provides high efficiency and enables the proposal to be evaluated on many levels, randomly adjusting the time scale that is difficult to accomplish in excel.

Download Financial Analysis Template for Business Models

Online, existing templates can be used by any agency, download a company financial analysis excel template for your business. The best part of this is that each successful model can be modified to fit your exact marketing plan. Don’t hesitate to take advantage of the opportunity to access rare templates designed by major banks and institutions.

DOWNLOAD