Non Profit Financial Statement Template

Non Profit Financial Statement Template

If you’re in charge of the finances of your non-profit organization, you need to be aware of the fact that the accounting tasks required of you will be different from those required of a for-profit company. The most practical way to keep up with accounting needs is to have a Non Profit Financial Statement Template that you use for all your accounting needs.

Those working in the non-profit sector need to understand their unique accounting responsibilities. Unfortunately, handling accounting and tax matters for a nonprofit can be complicated. You need to do your research to make sure you’re using the resources available to you to stay on top of your responsibilities.

Understanding the vocab

To get started, it’s a good idea to know the definitions of some key terms and concepts you need to be familiar with. Some of these terms are common to accounting tasks for both for-profit businesses and nonprofit organizations. Some of these terms refer to types of donations taken by nonprofits.

Here are six important terms to understand:

- Liabilities- The liabilities of a nonprofit or for-profit organization refer to anything the organization/company owes. Liabilities can include money owed for loans or for payable expenses.

- Revenue sources- Revenue sources differ significantly between for-profit and nonprofit entities. For a nonprofit, revenue sources will typically include donations, grants, dues for membership, investments, and program fees.

- Assets- Assets are anything a nonprofit or for-profit entity owns. These generally include cash and equipment pieces.

- Net assets- The net assets of any entity are all of the assets added up minus all of the liabilities added up.

Types of donor restrictions

Donations are a primary revenue source of most nonprofits. Donations can be classified in three different ways: unrestricted donations, temporarily restricted donations, and permanently restricted donations.

Unrestricted donations can be used for any need of the nonprofit, including daily operations. Temporarily restricted donations must be spent on a certain project over a particular period of time. Permanently restricted funds are given to the nonprofit to be used as investments.

The process of preparing financial statements

One of the things that nonprofits really need to focus on when handling accounting needs is transparency. Nonprofits need to make certain statements available to account for their revenue and spending. They should keep a non profit organisation financial statements template available to their staff members to make sure they are producing all necessary statements in the appropriate layout. The Generally Accepted Accounting Principles guidelines dictate that nonprofits need to prepare the following financial statements:

The financial position statement

This statement is basically like a non-profit equivalent of the corporate balance sheet. This statement will analyze all of a nonprofit’s various assets and liabilities.

The activities statement

This statement records all of the revenue of a nonprofit. This statement should also clarify whether certain revenue sources and expenses are subject to any donor restrictions.

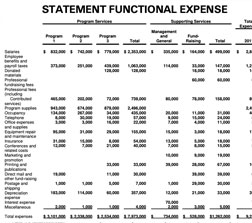

The functional and natural expenses statement

This statement will show a breakdown of all the expenses of the nonprofit. It should show what the nature of individual expenses are in a spreadsheet layout. This is an important part of a non profit financial statement template excel. This statement should also record all of the activities the nonprofit has been involved in as well as any accomplishments the nonprofit has achieved.

The cash flows statements

This is like the for-profit equivalent “statement of cash flows” document. It shows how cash is circulating throughout the nonprofit, and it is another vital component of a non profit financial statement template excel. Over a given period of time, a nonprofit’s cash flows could be either positive or negative.

There are three different parts to any nonprofit cash flow statement that should be worked into a Non Profit Financial Statement Template. These parts include an investing, financing, and operating section. The investing section covers any money the nonprofit has spent for investment or other longer term assets. The financing section is a report of any funds that have been borrowed and any loan amounts that have been paid back. The operating section includes any other information about cash flow at the nonprofit that was not included in the other two sections of the cash flow statement.

Accounting methods for tracking funds

Nonprofits need to be careful to track all of the funds that come in and go out of the nonprofit for the sake of transparency. In order to carefully track all funds, those handling accounting at a nonprofit should choose from between two different types of accounting: cash basis accounting and accrual basis accounting. It’s important for a nonprofit to figure out which accounting method it will use when devising its non profit organisation financial statements template.

Cash basis accounting

Cash basis accounting refers to tracking the revenue of a nonprofit every time the nonprofit receives physical cash. No record is made in the event of a mere transaction. Expenses are recorded when they are paid.

Cash basis accounting is most commonly used for smaller nonprofits. That’s because it cannot be used when a nonprofit has received more than $25 million in all of its gross receipts over the three previous years.

Accrual basis accounting

Accrual basis accounting focuses on transactions. Funds coming in to the nonprofit are recorded when an invoice is sent out rather than when the payment itself is actually received.

Understanding Form 990

If your organization qualifies as a nonprofit, it does not have to pay any federal taxes on the money it brings in. However, that does not mean that a nonprofit has no responsibilities whatsoever related to taxes. Nonprofits do need to file a form related to taxes that is known as a Form 990. This type of document allows both the Internal Revenue Service and the public to look at the nonprofit’s finances.

Another thing nonprofits need to keep in mind is that they do have to file a business tax return even though they are not liable for federal income taxes. Nonprofits may need to pay other types of taxes including property taxes or sales taxes.

DOWNLOAD