Payroll Spreadsheets

Payroll Spreadsheet Template

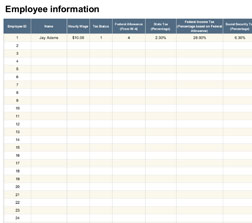

Managing payroll is a vital task for business owners to do to keep finances managed and make sure they are not going over budget. Additionally, using payroll spreadsheets, can allow small businesses to provide their employees with pay stubs and earning statements that they are able to use for tax purposes or things like getting loans or credit. There are many different ways for businesses to manage payroll, but many choose to utilize excel spreadsheets because it keeps the information organized and comprehensive, as well as takes advantage of excel’s built-in calculation software. Using an excel payroll worksheet template makes the process of managing payroll even easier, as all that’s required of you is to assemble the data and plug it into the appropriate location. Generally a payroll spreadsheet template includes ways to track employee information, schedule organization, calculating payroll costs, and generate earning statements.

How to use an employee payroll spreadsheet template.

1. The first step to filling out an excel payroll worksheet template is assembling all pertinent data. Things like hours worked per employee, tax rate information, and each employee’s individual scheduling needs are all things that may need to be used depending on what kind of template is being used.

2. The next step is the same for all payroll templates, this is when you will input all the information collected. It is incredibly important that information is being put into the correct category, it is also vital that all information is being tracked so as to ensure accurate results.

3. Allow excel’s mathematical abilities to work for you, excel will generate any totals and give you an accurate view of monetary amounts being used towards payroll and payroll related expenses.

Features of a payroll spreadsheet template.

Because there are several different types of payroll spreadsheet templates, they all offer slightly different features. A payroll register template includes a payroll register and a payroll calculator. This template allows for the tracking of things like vacation hours and deductions, and the payroll calculator sheet can be used as a pay stub as it shows gross pay, deductions and withholdings, net pay, and shows a breakdown of hours by type (normal, overtime, sick, etc.). A dashboard payroll report template creates a dynamic graphic way to view things like payroll allocation, employees in each department, and performance scores. An employee vacation tracker allows for the tracking of all vacation and sick hours used. This is a long-term view showing hours worked in each payroll period, hours used, and hours earned. A payroll deduction form template this is a way for employees to authorize deductions for things like retirement deductions and health care, these templates may need to be adjusted to fit legal requirements or company policies. These are just a few different types of payroll spreadsheet templates. There are also templates used for managing scheduling tasks, tracking attendance, and administrative spreadsheets for employees to fill out during on-boarding.

Optional tips

- It is incredibly important that all information used is accurate. This ensures that any calculations generated are correct. This also ensures that certain things like paid time off, earned sick days, and overtime are occurring when they are supposed to.

- Make sure that you are using and customizing the payroll template so that it increases efficiency for your business.

- It is recommended to assure your payroll template over time to make sure that it is still meeting your needs. As your business grows, more things may need to be tracked.

- Review any legal requirements that may need to be taken into account. This is especially important when it comes to tax-related items. Making sure that withholdings and deductions are correct, keeps your business from running into any legal issues and can assist with tax preparations.

- Payroll information needs to be adjusted anytime there is a personnel change. Not deleting terminated employees or adding in newly hired employees, will result in inaccurate amounts.

While managing payroll can be a tedious, time-consuming task it is a necessary step that needs to take place on a regular basis. Payroll spreadsheet templates can be used to manage employee information, generate pay stubs, keep track of money earned, manage legal-related items like deductions or withholdings, and tracking vacation, paid time off, or sick hours used. Additionally, payroll spreadsheets can be used for more administrative tasks like tracking payroll spent for specific departments, employee performance, schedule creation, and financial-related employee on-boarding documents. Using an employee payroll spreadsheet template makes this process much easier for business owners as it allows for all data to be contained in a simple, easy to access document and does all mathematical work for you. This allows for payroll management to be more efficient, and because digital payroll tracking eliminates the need for paper files, it makes information easier to find and makes a business’s workflow more streamlined.

DOWNLOAD