Personal Financial Statement Template Excel

Personal Financial Statement Template Excel

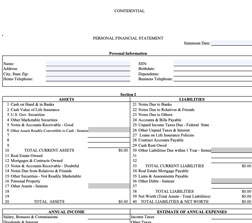

Creating good, strong personal finance habits can be extremely beneficial for a plethora of reasons. One of the first steps towards having good personal finance is creating a personal finance statement. A personal financial statement helps grow financial knowledge, assists with budget creation and maintenance, and achieving things like loans or credit. A personal financial statement usually contains things like a personal balance sheet, a cash flow statement, and a detailed worksheet. Additionally, it can include tools to help calculate items like Basic Liquidity Ratio, Debts-to-Assets Ratio, and Debt-to-Income Ratio. These figures are useful for gaining deeper insight into spending and saving habits, and can assist with achieving future financial goals. Using a personal financial statement template excel spreadsheet makes creating a personal financial statement incredibly easy, as it provides appropriate locations for all aspects of your finance, and it utilizes excel to quickly and accurately generate totals.

How to use a personal financial statement template Excel.

1. The first step is to fill out the personal balance sheet. To complete this sheet you will need to compile a list of all financial assets, these are things that maintain an exchange value like cash holdings, bank account balances, and real estate. Next, you will create a list of all liabilities, including any debts and unpaid bills. It is a good rule of thumb to include anything that shows up on your credit report within the liability section of the personal balance sheet. The final step of the personal balance sheet is to calculate net worth, which is found by subtracting the total of all liabilities from the total of all assets.

2. The next part of a personal financial statement template in excel is the personal cash flow statement. A personal cash flow statement is a record of all inflow (anything that brings money in), this inflow record is divided into the categories of “income” and “other”, so as to keep accurate accounts of where all money originates from. The other aspect of the personal cash flow is the outflow record, this is where all money leaving your possession is recorded, including items like living expenses and financing activities. Ultimately this statement is used to find the net cash flow, and this is done by subtracting the total of all inflow from the total of all outflow.

Features of a personal financial statement template excel spreadsheet.

- Personal Balance Sheet: This is a worksheet used for listing all assets and liabilities and finding net worth. The balance sheet also generates the debts-to-assets ratio, this ratio is essentially the amount of leverage that can be used for future financing.

- Cash Flow Statement: This sheet is used to list all inflows and outflows and calculating net cash flow. This statement greatly helps the creation of budgets as it provides an in-depth look into exactly where all monies currently go. The cash flow statement is used to find the debt-to-income ratio, a number used by potential lenders to determine financial security.

- Details Worksheet: This is where all financial details like account information and loan details. This sheet is used as a record to conveniently access all financial details in one place.

- Info Sheet: This sheet contains any information that a loan application may require. This information may include the contact information for any applicants and co-applicants.

Optional tips for using a blank personal financial statement template.

- Don’t include business assets or liabilities in the personal financial statement. Doing so can generate inaccurate totals.

- Make sure that all inflow and outflow details are categorized appropriately, so that it is easy to create an accurate budget from the cash flow statement.

- Make sure to record the calculations for debt-to-income ratio, debt-to-assets ratio, and basic liquidation ratio. Keeping track of these numbers over a long-term period can help make your finances more attractive to lenders, as well as help keep track of how efficient your finances are.

- For financial assets it’s incredibly important that these figures are accurate and realistic. For example, personal collections may hold a lot of sentimental or perceived value, but their true worth is only what they can be resold for. It can be helpful to use an appraiser to determine the actual value of collectibles, antiques, and artwork.

Creating an excel personal financial statement provides the tools needed to monitor financial health as well as set up habits for future financial success. A personal financial statement can help gain financial knowledge, build more successful financial habits, easily create a budget, and may help with loan applications. Utilizing a blank personal financial statement template makes creating a personal financial statement simple and streamlined, and creates a comprehensive document that can be used for a variety of purposes. Additionally, because excel does all the calculations and number crunching, using a personal financial statement template is as easy as plugging in the amounts for each category.

DOWNLOAD