Pro Forma Income Statement Template

Pro Forma Income Statement Template

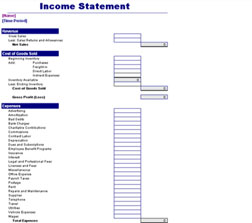

Pro Forma Income Statement Template Microsoft Excel

What Is An Income Statement?

A company’s income statement is one of its most important financial documents. It details the amount of money made and spent within a certain period. Profit is the combination of all revenue, and losses and is described as the cumulative expenses stemming from operating and non-operating endeavors, such as overhead, fees, and taxes.

What Does Pro Forma Mean?

The term pro forma refers to any standard business document. Exceltemplates.com has a pro forma income statement template that can be used as an example.

When it comes to corporate money management and accounting, an income statement is considered one of the three most commonly used documents. It can be configured to show total revenue, expenses such as taxes, and gross and net profit. These statements are arranged in an ordered fashion so that they are easily understood.

The details found in income statements are separated into periods of time which represent actions taken by a business. Monthly divisions are common, especially when the statement being drafted is part of an internal report. It’s also not unheard of for a cycle to consist of thirteen periods. The final versions of statements are often presented with yearly or quarterly values.

What Goes Into An Income Statement?

The composition of an income statement will vary between different businesses and industries. This is because the financial laws can change depending on circumstances such as: where a business is located, where its money is being made, how much profit is being made, and vast number of other factors.

That being said, there are several boilerplate concepts included in virtually every version of an income statement. Here are some examples of such items:

Revenue From Sales

Revenue is the income a company has generated from selling goods or offering services. This part of the statement is usually visible very early in the document. To calculate revenue, all expenses are combined with the cost of either producing and shipping out goods or servicing customers. It’s not unheard of for some businesses to combine all their income streams into one line.

Cost Of Goods Sold

COGS is an item on an income statement that pulls together the expenses linked to the generation of revenue from selling products. Expenses usually include parts, materials, and labor. You’ll also have to take depreciation into account.

Profit (Gross)

The gross profit is determined by subtracting the COGS from the sales revenue.

Marketing Expenses

A business can’t make money if no one knows it exists. Promotion is a very important concept in any enterprise. That’s why companies will shell out up to millions of dollars on advertising. All of the processes and events that raise a company’s profile are typically listed together as expenses.

General Expenses

General and administrative expenses include indirect costs like payroll, renting space, insurance, travel costs, depreciation, and amortization (lowering loan payments). These costs are lumped together in your typical pro forma income statement template.

EBITDA

This item isn’t found in every income statement, but it is a handy figure:

Earnings

Before

Interest

Tax

Depreciation

Amortization

To calculate EBITDA, subtract the general and administrative costs except for depreciation and amortization from the gross revenue. The two costs that were excluded are cashless expenses. Accountants instigate depreciation and amortization to stretch out and diminish the costs of physical assets like property and equipment.

Operating Income

This income is what comes from the business a company normally conducts. Put another way, it’s all the revenue without taking into account non-operating income, expenses, taxes, or interest. A popular term associated with operating income is EBIT – Earnings Before Interest + Taxes.

Interest

It’s a popular practice for companies to isolate interest-related items like expenses and income in an income statement.

Additional Expenses

Many times, a business will have costs that are unique to their industry. Technological innovations, R&D, compensation from stocks, investments, and much more can also be included in an income statement in need be.

Pro Forma Income Statement Template Microsoft

Pro forma income statement excel templates can be used to portray a business’s finances accurately and succinctly. When they’re done well, these statements can be used to make predictions about how a company will perform in the future.

We put together a rundown on how your income statement should be constructed. If you need an impressive pro forma income statement Excel has templates available for download.

Enter historical information from every time period on record into an Excel template. You’ll want to arrange the data in a format that distinguishes between hard-coded and calculated data. One clever trick is to color code everything; make hard-colored data blue, and make calculated data green. This helps avoid confusion when examining the statement.

If there are any trends in the data, they’ll become noticeable after careful inspection. Proper analysis can lead to financial forecasting. If you keep an eye on the sales revenue, it’ll be easier to predict whether profits increase or decrease in the future.

Lastly, using analysis to make projections about how a business will fare in the future is an art, not a science. Pay attention to all the metrics described earlier in this article and you’ll be able to calculate estimates for the items in the Excel templates, but never assume you know how making a change based on these estimations will work out.

DOWNLOAD