Business Profit and Loss Statement Template

A profit and loss (P&L) statement is a financial tool that summarizes the costs, revenues, and expenses incurred by a business during a particular period (typically a year or a fiscal quarter). If you don’t know how to create one, you’d be happy to know you can always download a business profit and loss statement template.

Profit and Loss Statement in a Nutshell

A P&L statement sets the company income versus expenses so you can calculate profit. In essence, a profit and loss statement provides data about a company’s ability (or inability) to generate profit by reducing costs, increasing revenue, or both.

A profit and loss statement is also referred to by many other names, including income statement, statement of operations, expense or earnings statement, and statement of financial results.

Preparing Your Profit and Loss Statement

Periodic P&L

Ideally, businesses should prepare and review their profit and loss statement at least once every quarter. Reviewing your P&L on a routine basis will make the preparation of the tax return easier and help you make educated business decisions.

Information derived from the P&L will be used as a basis when calculating the net income, so you’ll know how much income tax you need to pay.

Pro Forma P&L

New businesses also need to create a P&L statement at startup. The statement is created pro-forma. In other words, it is projected into the future. A pro-forma can also be helpful when applying for funding for new business projects.

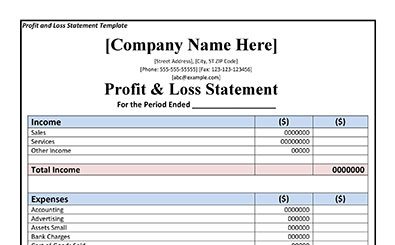

To create a profit and income statement effortlessly, download the business profit and loss statement template, and you’re good to go!

Understanding Your Profit and Loss Statement

Just like the cash flow statement and balance sheet, your profit and loss statement is one of the financial statements you will issue quarterly and annually. Understandably, the P&L is one of the most popular financial statements as it clearly indicates the profit or loss generated by your business over a period of time.

Your P&L statement will also show the changes in your finances over a set period. On the other hand, the balance will provide a snapshot of what your company owes and owns at a given time.

Typically, P&L statements begin with an entry for revenue. The costs of doing business will be subtracted from the revenue. Cost of doing business can include tax expenses, cost of goods sold, interest expenses, and operating expenses.

The difference will be your net income. Net income is also referred to as earnings or profit. It is recommended that you compare P&L statements from various accounting periods as any changes like net earnings, operating cost, etc., can tell you a lot about your business (and finances).

For instance, while your revenue can grow significantly, your expenses might be growing at a faster rate.

Creating a Profit and Loss Statement: Best Practices

Aside from using a business profit and loss statement template, below are some of the best practices to keep in mind when creating a P&L statement:

Pick a time frame

- When do you intend to assess the progress of your business? Is it monthly, quarterly, or annually? Often, short time frames won’t yield valuable data (i.e., anything that’s less than a month). On the flip side, it is also not ideal to be digging into months and years’ worth of data.

- Take note of your business revenue for a given time period. Break them down into monthly totals. It is also recommended that you list down your income sources by month.

- List down and calculate your expenses. Separate direct costs like your cost of goods sold (COGS) from your operating expenses (OPEX).

- Subtract your direct cost from your revenue to determine your gross profit. To determine if you are making money, subtract the total expenses from your gross profit. If your result is positive, you are on the right track. Otherwise, you have all the information you need to get your business back on track.

Profit and Loss Statement Template: Your Helpful Ally

If you are like most people, you likely find the mere idea of creating a P&L statement intimidating enough. How do you figure out what to include in your P&L? With a profit and loss statement template, you never have to wonder.

A P&L statement template can help you create a detailed picture of your business so you can check performance, strengths, and areas for improvement. Your profit and loss statement template can also give you the data your company needs so you can compare it against other businesses in the same niche and create industry benchmarks.

The US Small Business Administration suggests that you print your P&L statement routinely so you can closely monitor business performance.

DOWNLOAD