Rental Property Profit and Loss Statement Template

Renting out real properties makes for a very lucrative investment. You get a steady stream of income every month, as long as you have tenants.

Like every other business venture out there, though, rental property owners also need to track their monetary successes and failures to effectively manage their cash flow and get the most out of their investment.

Some landlords still use the pen and paper method for managing the finances of their rental properties — which is okay if you only have one or two. If you have a growing rental property portfolio, however, that might not be the best choice. You’ll need something that can help you efficiently calculate and analyze cash flow, and determine all important financial data of your rental property business.

Stay on top of your bookkeeping duties with this Rental Property Profit and Loss Statement Template for Excel!

All About the Rental Property Profit and Loss Statement Template

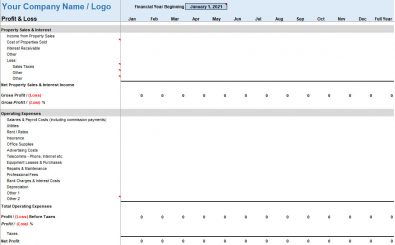

The Rental Property Profit and Loss Statement template is specifically designed to provide businesses that own and operate rental properties an uncomplicated yet comprehensive tool for tracking their rental and activities, and all the resulting profits and losses.

This particular worksheet allows you to create a detailed reporting of your operating income and expenses, and provides you with an overview of how much money you’re making or losing every month.

Whether you use the template as a hub for summarizing your rental cash flow, or a baseline for creating your own worksheet, it can definitely help you get a clearer view of your finances and gauge the effectiveness of your business operation.

Download the Rental Property Profit and Loss Statement template here.

Elements and Features

The Rental Property Profit and Loss Statement Template creates a detailed reporting and summary of your income and expenses from four distinct categories:

- Rental Costs and Income

The first two categories summarize the monthly operating income and expenses of the rental properties. The net rental income calculates the total profit/loss for the month, after all rental costs are deducted.

The Rental Income includes any service charges paid by the tenants.

The Rental Costs include utilities, repair and maintenance, property taxes, property insurance, and other operating expenses paid for by the company/owner.

Both Rental Income and Rental Costs categories have an “other” line where you can enter one-off income or expenses. - Property Sales and Interest

The Property Sales & Interest section calculates the gross and net profit in case a property is sold.

This category displays both income and expenses, so you should remember to enter any income as positive (+) and any expense as negative (-).

The Gross Profit/(Loss) is the combined total of the Net Property Sales & Interest Income and Net Rental Income.

The Gross Profit/(Loss) % is the total return on revenue percentage before operating expenses are deducted. - Operating Expenses

This section is a rundown of all the monthly costs of operating your rental property business.

It covers everything from employee salaries (if you have employees) to bank charges and interest (if you’ve taken a loan to fund your properties).

Like all sections in the worksheet, you can edit the cells to reflect all your recurring operating expenses.

There are two “other” rows for any unique expenses you might have for the month. - Before and After-Tax Profit

The fourth section provides a summation of your profit/loss before (profit/loss before taxes) and after taxes (net profit/loss).

The Profit/(Loss) % reveals the gross rate of return from all your income sources, while Net Profit/(Loss) % is the percentage revenues, after taxes.

Other Notable Features:

- The worksheet covers a twelve-month period.

- The template is formatted to view and print in landscape format for easier reading.

- It provides monthly profit/loss data and combines these results to calculate a full-year profitability information.

- The full year column will automatically track and tally the monthly results as the year progresses.

How to Use

Using the Rental Property Profit and Loss Statement Template is a pretty straightforward process, which makes it ideal for beginners and less tech-savvy individuals.

All you have to do is fill in the cells in each category with their designated totals for the month and the worksheet will compute a both net and gross profit (or loss) for you.

The best part? The entire template is customizable. You can create or delete categories, add more cost/expense entries, and adjust the entire worksheet to fit the unique needs of your business.

Benefits of Using Excel for Profit/Loss Tracking and Analysis

- Excel is a powerful business management and accounting tool, with a wide range of functionalities.

- You can use Excel to generate profit/loss forecasts using previous data.

- Data manipulation is much easier with Excel. Write your own functions and formulas as you see fit. You can even create graphs and charts within the worksheet to exhibit trends more clearly.

- Excel provides small and medium-scale rental property owners with cost-effective profit/loss tracking and analysis solutions. The Rental Property Profit and Loss Statement Template is free to use and download long as you have a Microsoft Office Package installed in your computer.

- Overall, Excel is easily the most affordable and user-friendly way to track and organize your rental property income and expense data, and remain financially informed!

Click here to download your Rental Property Profit and Loss Statement Template.

DOWNLOAD