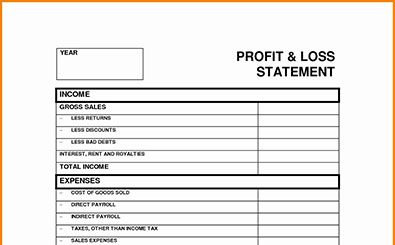

Self Employed Profit and Loss Statement Template

From quarterly taxes to invoices, self-employed individuals have a lot of paperwork to manage. While you are not legally required to file a profit and loss (P&L) statement with any regulatory agency, compiling one is recommended, so you will have a clear picture of what is going on in terms of your business finances.

On the surface, keeping a profit and loss statement can seem complicated and perplexing. Fortunately, with a self-employed profit and loss statement template, the process can become easy and straightforward.

Profit and Loss Statement in a Nutshell

Also referred to as income statement or P&L statement, a profit statement is a tool that measures your business revenue (sales or income) during a specific period. In other words, it tells you whether your business is making money or not.

According to the U.S. Small Business Administration, the profit and loss statement is the best tool you can use to gauge if your business is profitable. Typically, a profit and loss statement is assessed monthly, quarterly, and annually.

Depending on how big and complex your business is, your profit and loss statement can be just a few lines or can be pages long. The good news? Regardless of how big or complex your business may be, a self-employed profit and loss statement template can help make everything simple and easy to understand.

The Purpose of Your Profit and Loss Statement

Primarily, your profit and loss statement is used to calculate your loss or net operating profit. If you are making a profit, you can save, re-invest, or use it for other business decisions. If you end up with a loss, you need to develop a strategy to turn things around.

Your profit and loss statement can also help you clearly answer some crucial business questions, including:

- Can I afford to hire additional employees?

- Can I afford to move to a new and bigger office?

- Is my current growth strategy effective?

Business investors can also check your profit and loss statement from various periods to get a clear picture of how profitable your business is. The P&L statement will also give them an idea about your competitiveness as a business, the efficiency of your operations, and your business model’s strength.

Some lenders will check your P&L statement to gauge if your business can be profitable enough for you to pay back loans and interests.

Understanding Your Profit and Loss Statement

For most people, creating a profit and loss statement can be a bit daunting. This is especially true for those who are creating one for the first time. This is why profit and loss statement templates can be very beneficial. They are designed to make the process quick and easy for you to understand.

There are common line items that are typically included in many P&L statements. Some of the terms you will encounter include:

Revenue: P&L statements typically start with a summary of sales revenue during a given time period. This is often detailed in another table, and the total is imported in your P&L statement.

Expenditure: More detailed P&L statements will provide information on the different types of expenditure. It is possible for several expenses to be included. However, this can vary depending on your business.

Gross Profit and Gross Margin: To determine your gross profit, you need to subtract direct costs from your revenue. Gross margin, on the other hand, is typically depicted as a percentage. Also known as gross profit margin, it is calculated by deducting the cost of goods sold (COGS) and dividing the difference by the total revenue.

The gross margin result is multiplied by 100 to show the result as a percentage. The gross margin is also considered one of the critical indicators of the financial health of your business. It also helps gauge the soundness of your business model. That said, the higher the percentage, the better.

Understandably, many potential investors will zero in on this number as it can also indicate how competitive your current business is or how competitive it can be in the future.

Operating Expenses or OPEX refer to the costs of normal business operations. Operating expenses can include:

- Insurance

- Payroll

- Administrative costs

- Rent

- Office supplies

- Utilities like internet service and phone

Net Income (Profit or Loss): The net income is calculated by subtracting your indirect expenses from the gross profit. Your net profit (or loss) is the bottom line of your P&L statement. This is used to determine if the business is profitable or not and by how much.

If the result indicates a profit, it means you made more money than you spent. If the results show a loss, it means you spent more than you earned.

To manage your business accordingly, creating a profit and loss statement is crucial. Fortunately, a self-employed profit and loss statement template can help make the process easy and straightforward for you!

DOWNLOAD