Small Business Financial Statement Template Excel

Small Business Financial Statement Template Excel

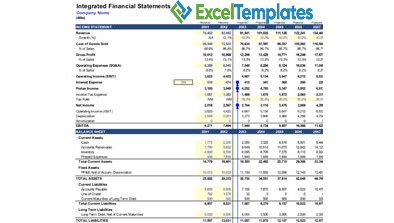

FINANCIAL STATEMENTS

A small business financial statement is a document that provides detailed information about the performance of a business or non profit organization. It is used to keep track of things such as income, expenses, assets, liabilities and net profits. When putting together a small business financial statements template in excel, it is important to use a specific template for small businesses. One of the most common types of templates is the business financial statement template. This type of template will provide details of the total income and expenses for a company. Companies will usually use a business financial statement excel template in order to accurately document the performance of their organization.

FORMAT

A business financial statement excel template has a certain format that enables people to more easily analyze and evaluate the business. With a business financial statement excel template, there will be a certain type of statement as well as a list of many different types of transactions. For example there will be lists of things such as sales receipts, cost of goods sold, purchases, rents, utilities, salaries and depreciation. These statements will also have information such as cash in the operating account, petty cash, accounts receivable, accounts payable, payroll taxes payable and equity.

PURPOSE

Businesses and nonprofit organizations have one main purpose when putting together financial statements. The purpose of having different financial statements is to better track, organize and analyze all of the financial activities in their organization. With financial statements and their specific templates, companies and nonprofits entities are able to determine if they are reaching their financial goals and if they need to make adjustments with their budget in order to avoid bankruptcy or closure. Financial statements are also necessary to acquire capital through loans and also get investors to provide capital.

BOARD APPROVED FINANCIAL STATEMENTS

Whenever an organization is looking to put together and submit their financial statements, they will often look to get them board approved. With a board approved financial statement, a business or non profit organization will be in position to ensure that their statements are legitimate and are sufficient for presentation to lenders, investors and government entities.

CERTIFICATION OF ENCLOSED STATEMENTS

Another thing that companies and nonprofits will look to get is a certification of enclosed statements. This provides assurance that the financial statements are sufficient for compliance with the government and other organizations. It also assures a business or non profit that the statements are secured and can be easily submitted without any confidential information being compromised.

TYPES

There are many types of financial statements templates that can be created with excel. These financial statements include a profit and loss statement, a balance sheet, a cash flow statement an expense statement and also a financial statement for business plan template. With all of these different types of financial statements, businesses and nonprofit organizations will be in a better position to track their performance with accurate information that is up to date.

INCOME STATEMENT

One of the most common and significant types of financial statements is the income statement. This type of financial statement tracks all of the income and expenses for a business. The statement is organized by putting together a list of certain accounts and then calculating the totals for each of these accounts. For example an income statement will include information such as sales, purchases and gross profit. It will also include all of the expenses as well. The income statement will then subtract the total expenses from the gross profit in order to determine the net profit or loss for a given period of time.

CASH FLOW STATEMENT

Another important type of financial statement is the cash flow statement. This provides information pertaining to all of the activities that contribute to the overall cash flow of a company. The statement provides cash flow for operating activities such as profits and losses. Another part of the statement is investing activities in which the statement will reveal how much cash flow is coming from investments. Lastly, the statement contains information of financing activities that track loans and progress in paying debts.

BALANCE SHEET STATEMENT

The balance sheet statement is another one of the most important financial statements that a business or non profit needs to have. With a balance sheet statement, an organization can provide detailed information about their assets, liabilities and equity. This is used to help determine the overall net worth of a business. The typical format of this statement will consist of a list of current assets such as bank accounts and petty cash. It will also include a list of fixed assets such as machinery, equipment, buildings and vehicles. On the other side of the statement is the liabilities that include short term liabilities such as accounts payable and payroll taxes. This statement will also include long term liabilities such as loans. At the end of the statement is the owner’s equity, member equity or retained earnings.

EXPENSE STATEMENT

A business and non profit can also use an expense statement in order to find out how much money they are spending on certain things. With an expense statement, an organization can closely monitor in detail what expenses they are paying more frequently and where most of their money is going. It can also be used to help them find expenses that they can cut in order to save money and increase their profits. An expense statement will usually be made each month and will have each expense listed. The list often includes things such as salaries, payroll taxes, rents, utilities, insurance payments and employee benefits. This is yet another essential statement that can help an organization better manage their finances.

BUSINESS STARTUP COSTS

For new companies such as startups, they will often need a statement in order to get capital from investors and loans from lenders. Since they do not have any record of running their business, they will often need to rely on a financial statement for business startup costs. Therefore, they will use a financial statement for business plan template. This document will provide information about the assets of the owners, the upfront capital it has and also the projected revenues and expenses for the first year. It may also include forecasts for what it expects to make and pay during a period of five years. With this statement, startups are in a better position to demonstrate their potential to investors and lenders in order to get the financial assistance they need to start and manage their companies.

CONCLUSION

With a variety of financial statements, businesses and non profit organizations will have documentation of their performance. With these documents, they will be in position to know where they stand financially as well as how they can improve their financial situation. Along with knowing their financial situation at all times, organizations can also have the documentation necessary to get the capital they need more easily.

DOWNLOAD