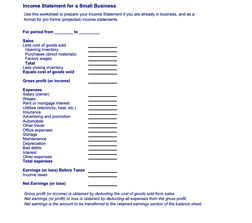

Small Business Income Statement Template

Small Business Income Statement Template

Income Statement Template Excel Small Business

When you examine an income statement and/ or a balance sheet, it can be easier for you to understand how these reports affect each other and your small business. Whenever a company makes a sale or lists an expense for the record, balance sheets and income statements update to reflect these changes. These are two of the three most important financial documents a small business will need (the third being a cash flow statement) to generate a report documenting financial status. Excel has templates that small businesses can download and use.

We’ll take a closer look at the relationship between these statements and how the day to day operations conducted by your small business impact them.

How Do You Fill Out An Income Statement Or A Balance Sheet?

Download our small business income statement template excel here.

Both documents employ several metrics to detail accounting measures for a business. Taking a closer look at the details on each type of report can highlight similarities and key differences.

Income Statement

Also known as a statement of profit and loss, this document reports the revenue gained, expenses incurred, and total profit or loss made by a company within a given time period. The itinerary of a typical income statement will have:

Revenue: The profit made from selling goods or providing services

COGS: Cost of goods sold. Also includes labor and parts or materials

Gross Profit: Revenue minus COGS

G&A: General and Administrative costs – rent, salary, utilities, overhead, and more

EBT: Earnings Before Tax. How much money your business has before taxes are taken out

Net Income: All remaining revenue after all costs, fees, etc. have been accounted for. Will be reported as a profit or a loss

What it boils down to is that income statements are geared towards displaying the net income of a business for a certain period, usually a quarter or a year. Positive numbers indicate profit, and negative numbers indicate a loss.

Balance Sheet

This document showcases a company’s equity, liabilities, and physical and financial assets for a specific period.

Most balance sheets are divided into two sections. The first section shows assets, and the other section shows equity and liability. The idea is for both sections to balance out, or display figures that are equal to each other. The figures in particular include:

Contemporary Assets: These assets (accounts receivable, expenses that have already been covered, inventory) are turned into cash within twelve months

Long-Term Assets: Assets that won’t be converted to cash within a year, including land, buildings and equipment

Liabilities: This term is for debts that need to be repaid in no more than a year. Examples include taxes, utilities, payroll, and rent

Long-Term Liabilities: Funding for pensions and long-term loans for businesses

Shareholders Equity: All of a company’s assets, such as revenue and donations.

Using all of these metrics, a balance sheet shows you everything owned by your company and everything it owes to other entities. It gives you an estimate of your business’s net worth.

What Are Some Differences Between Income Statements And Balance Sheets?

Every financial document a business possesses relates to the other in some way. Often times there’s an overly between some of the information different statements indicate. The difference is why they have certain information.

Since some financial documents obtain information from one another, it becomes possible to develop an order in which to create them.

1. Income Statement (exceltemplates.net has income statement for small business template)

2. Balance Sheet

3. Cash Flow

When it comes to preparing a balance sheet, it’s important to calculate the net revenue. This is the last calculation to appear in an income statement. It becomes clear whether or not your company is making or losing money most at a point in time. Once net revenue is determined, the balance sheet is put together.

Net income can be found on balance sheets – check the line item labeled “retained earnings.” Net revenue changes the amount of equity in financial reports.

In some instances of bookkeeping, the balance sheet and income statement are closely linked together. Double entry bookkeeping consists of creating two distinct entries for each transaction that makes it to record. One entry makes it to the income statement, and another makes to the balance sheet.

Small Business Income Statement Template Excel

Exceltemplates.net has a template that can function as an income statement for small business template.

As long as you keep your income statement and balance sheet separate, they will help you figure out how to plan the future out for your small business.

Download Income Statement Template Excel Small Business here.

DOWNLOAD