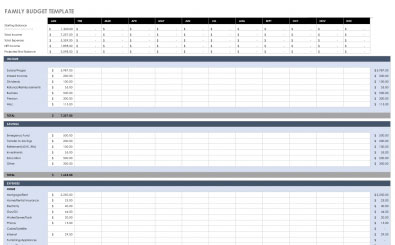

Excel Family Budget Template

Are you in debt? Do you live paycheck to paycheck? Do you wonder where all your money went even though you have just been paid? Then you may have issues with money management.

Perhaps you do not struggle with managing your money, but you take your financial future seriously and want to plan for things like buying a car, a house for your family, or helping kids through college. Either way, you’d benefit immensely from having a family budget template.

And if you are wondering where to start, you can use our Excel family budget template to help you and your family accomplish these financial goals.

Why You Should Have A Budget

Budgeting lets you plan how you spend your money and can provide numerous benefits. An Excel family budget template:

- Gives you control over your own money

- Helps you stay focused on your monetary goals

- Shows you exactly where your money is going

- Provides a way to organize your spending and savings

- Makes it easier to set aside money for emergencies and unexpected costs

- Acts as a communication tool between you and your family

- Brings attention to your problem areas (like overspending or seeing in advance that you do not have enough money to cover your bills)

- Enables you to make a profit (if you find you can eliminate unnecessary expenses)

If you are new to budgeting, do not waste time (and sanity) trying to create your own Excel family budget template spreadsheet. This can be such a hassle. You can easily find a family budget template online that meets your needs.

And when it comes to your family budget template, Excel compatibility is a must because the best budgets are in spreadsheet form, as they allow you to make calculations automatically. This is part of why using a premade excel family budget template spreadsheet is the way to go. You do not want to worry about setting up different functions.

How to Use Our Template

Excel Template’s family budget template is designed with you in mind to account for everything you would possibly need. Here is a step-by-step guide for you:

- Click the link to download, and it will automatically open in Excel.

- From there, you are ready to get started financially planning your future.

- At the top, you’ll have a quick snapshot of your net income and ending balance month by month. These figures will be calculated by filling in the numbers associated with each line item under the month you are in.

- Enter all your income (this will be broken up into categories like wages, dividends, etc.), then input the amounts associated with your savings (like your emergency fund, 401k, and educational funds).

- Next, you will deal with your various expenses. Your expenses will be broken down into major categories, such as home or transportation. If you encounter a line item that doesn’t apply to you, skip it. You don’t need to enter anything.

- Once all the information that applies to you and your family is filled in, you can see all your totals for each category and have the simple, quick-read representation of your final income, expenses, and current balance at the top of the spreadsheet.

Features of a Family Budget Template

The best feature of our template is the quick-read representations of your total income, expenses, net income, and end balance for each month. This convenient tool will allow you to see exactly where you are at and plan for the following month.

The template also does an extremely thorough job of considering almost every financial figure you should be keeping track of.

Income

Your income can include the following:

- Salary/Wages

- Interest Income

- Dividends

- Refunds/Reimbursements

- Business

- Pension

- Miscellaneous (any income that doesn’t fall into the other categories)

After all your income is entered, a line displays your total income.

Savings

Your savings will be broken down into categories such as:

- Emergency Funds

- Transfer to Savings

- Retirement (401k, IRA)

- Investments

- Education

- Other (anything you want to save for that doesn’t fall into the other categories)

After you’ve entered all your figures, there is a line that displays the total amount allocated for savings.

Expenses

Your expenses can be broken down into major categories. Under each category, there are line items, and you will be given subtotals for each category so you can see exactly where your money is going. The major categories include:

- Home

- Transportation

- Daily Living

- Entertainment

- Health

- Vacation/Holiday

In addition to the subtotals for each major expense category, a total expense amount will be calculated and displayed.

Overall, our template will allow you to budget month by month for the entire year, and if you are familiar with Excel, you can add and delete lines when necessary as your life changes throughout the year.

Tips for Using Our Excel Family Budget Template

While the template is quite thorough, you may have an expense not accounted for or want to save for something specific that is not included on the spreadsheet. You may consider familiarizing yourself with some of Excel’s features, such as adding and deleting lines and copying formulas.

You should also understand that this is a budget, more like an estimation. Hence, don’t worry about knowing the exact amounts. Use your best judgment.

Furthermore, when in doubt, it is always better to underestimate your income and overestimate your expenses. This will help save you from falling short on money and identify a financial emergency in advance.

Finally, you should try to be diligent in sticking to your budget. Whatever your financial goals are, a budget is the first step in achieving them.

Download our Excel family budget template today!

DOWNLOAD