Pro Forma Balance Sheet Template

Pro Forma Balance Sheet Template

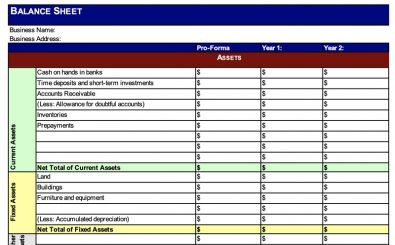

In order to show how to use a pro forma balance sheet template, you need to understand the structure of this template first. It is very important because this structure will help you make the most out of your pro forma balance sheet. You have to be aware of what type of information is shown on the pro forma balance sheet.

The balance sheet can be used to obtain the information about the company and their position in the market. This sheet is also used to calculate the profit of the company. Therefore, it helps in calculating the stock prices.

A pro forma balance sheet can be created by following these simple steps. The business loan officer will first create the financial statements. After this is done, the accountant will put the information into this easy-to-use sheet.

Next, the accountant will fill in the column names and enter the figures. The accountant will provide the document that has been created by the loan officer. The sheet is divided into four main sections. These sections are: Summary, Loan, Cash Flow and Stock Prices.

In order to determine how to use a pro forma balance sheet template excel, you have to know the outline of the financial statement. This will help you understand the data entered into the financial statement.

How to Use

The first thing that you have to do is to go to the financial statement. In the first column, you will see the balance that is calculated on a month-to-month basis. The next section will be the cash flow. The section is where the figures will be entered for the current financial statement.

After this, the stock prices will be included in the second column. This will be an overview of the stocks. The last section will be the Notes and Miscellaneous Statements.

You will come to find that using a pro forma balance sheet template excel is very simple. The only task, that you have to do is to follow the easy steps mentioned above. There are some tips and tricks that you can use in order to save time when you are filling up this sheet.

Key Features

Beginners often feel perplexed by the complexity involved in making a pro forma balance sheet file. They are also unsure of how to get started with creating their own balanced sheet or how to find a suitable spreadsheet template. In this article we will discuss the Steps to making a pro forma balance sheet template spreadsheet.

In order to get started there are a few things that need to be included, and it is best to get one that is of good quality. The first section is for assets. The next section is for liabilities and equities. This includes current assets and all other assets that are currently owned by the company.

The next section of the pro forma balance sheet template spreadsheet is for the current assets. This includes current investments as well as any existing debts that the company may have.

This section includes Current assets. This includes current investments. If any businesses are set up or if companies are closed down the current assets section will include these figures.

The next section is for liabilities and equities. This includes current debts as well as any past debts. It also includes any fixed assets that the company has that is not now being used.

The next section is for liabilities and equities, this includes fixed assets such as factories, workshops, and vehicles. It also includes loans that the company has with both banks and other forms of investors such as the government.

The next section is for fixed assets such as buildings and offices. It also includes any future investment that the company may have. This will include any property that may be sold or purchased later on.

The last section is for income. This includes profits and the amount of money that the company earned in the previous period.

The next step involves the current assets of the company. This includes any current investments that the company has as well as any assets that the company still owns and any assets that may be purchased within the next three months.

This is done in order to find the value of any assets that may have been acquired during the previous period. This is an estimate of what the company would have paid to get this asset. The pro forma balance sheet will automatically use the actual amount of money that the company had to pay in order to purchase the asset.

Optional Tips

Some of the issues that you have to pay attention to are included in the small print. Small print refers to the footnotes that contain information on how to use a pro forma balance sheet template. The footnotes contain information about the calculation results.

For example, you may find the information on the footnotes of the table. If you are going to use a pro forma balance sheet template, the information is printed on the table, including the column headers and the data. This will give you a better understanding of the table.

It is important to make sure that the percentages are correct when calculating the monthly basis. The balance sheet should be used at least every six months to ensure that the balance sheet accurately reflects the income that the company has received.

Making a pro forma balance sheet spreadsheet is relatively easy. The key is to ensure that the spreadsheet contains all the information required in order to calculate the monthly cash flow that the company has earned. This information will then be used to determine which types of assets need to be sold off in order to increase the company’s bottom line.

Another tip to keep in mind is that the calculation figures should be entered on the column header that has the information on the table. If you were to enter them on the last row of the table, it would not be easy to determine the figures. The calculations of the profit of the company are also the key point that you have to consider. The financial statement will also include the profit and operating expenses.

You can use a pro forma balance sheet template spreadsheet to keep track of the figures of the companies for the purpose of maintaining the records of the company. In order to create a pro forma balance sheet document, the business loan officer will also prepare the financial statements and also the letter of no objection.

DOWNLOAD