Year End Balance Sheet Template

Year End Balance Sheet

Year End Balance Sheet Template excel

Any leading executive for a company will be able to tell you that financial metrics are ultimately what drives the business forward no matter what industry they are in. If you are capable of maintaining accurate records and responding to the data as it comes inappropriately then you will skyrocket your chances for success. That is why learning how to use the Year-End Balance Sheet Template spreadsheet could be an absolute game-changer for you and your business. At the end of the day, it should go without saying that having a tool that can help you organize the financial metrics that are vital to your business could be a game-changer for almost anyone. However, the Year-End Balance Sheet Template will only be as useful as the individual who is using it. That is why in this article we are going to go over in-depth exactly how to get the most benefit out of using this product. With your experience with computers is extensive or limited by the end of this you should feel confident in your ability to utilize this template to help with your year end balance sheet template spreadsheet from here on out. So let’s begin.

Year-End Balance Sheet Template excel

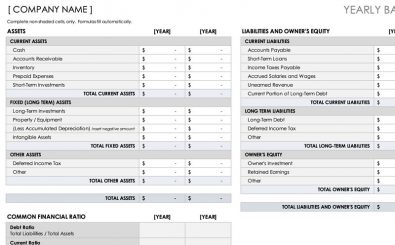

Of course, anyone who has had any experience working in finance or accounting will be able to tell you that the year-end balance sheet is vitally important for the company. It tells us at the end of every year exactly what the net worth of the company is by comparing the assets that it holds versus the liabilities that it does. The Year-End Balance Sheet Template spreadsheet gives us an easy and intuitive way to go about recording this data that is easy to create and to read from so that you can gain valuable insights into the financial aspects of your business. It is going to run on the software Microsoft Excel. Once you have finished downloading the file from our website you can click on it to open it up in Microsoft Excel. After it has finished opening up you will see the spreadsheet. The spreadsheet will be composed of numerous rows and columns. If you look closely you will see that some of these already have some data entered into them already. You can tell that everything has been broken up into separate areas. These areas will be your assets and other positive cash flow items for your company’s portfolio, the liabilities and owner’s equity that remain on your company’s portfolio as well as other miscellaneous items that do not fit into either of these two categories in a clean-cut way.

In order to fill out the Year End Balance Sheet Template, we are going, to begin with, the assets column area. Once it has reached the end of the year you need together with a list of everything that the company owns on record. This can include tangible and intangible assets. If you would like to keep the most organized and accurate records possible, it is recommended that you follow the format and break everything down into both long-term and short-term assets. Anything that is an investment or other asset that is expected to hold its value for five years or more for the company will be classified as long-term assets. Anything that will be liquidated in less than five years and provide positive cash flow for the company within that timeframe will be considered a short-term asset. Once you have everything gathered you can input all the data into the appropriate categories. At the very bottom of this area, you will see a total column. Add everything up for all of the asset categories in order to get your total asset value.

Now that we have completed the assets category area we will move on to the liabilities and owner equity. Let’s begin with the liabilities by filling out all of the debts and other negative cash flow items that the company is holding onto. Anything that is less than five years for its term links will be placed into the short-term liabilities area. Anything that is greater than five years for its term length would be placed in the long-term liabilities area. You will finish up this area by calculating whatever the owner’s equity stake is in the company and how much of that will be paid out within the next five years and how much we paid out over five years from now. Put these into the long-term and short-term owner equity areas. Once you have all of this information you can go ahead and add all of the totals up to get the total liability and owner equity value.

Below this area on the spreadsheet, you will see a net income calculator. Here he will input the information from the total net value of assets and then subtract the total net value of liabilities and owner’s equity. The sum that you get from this subtraction will be the total net worth of the company. This is everything that the company owns minus all of the debts that it owns.

Now that you have finished filling out the spreadsheet we can go ahead and save the file so that you will be able to easily retrieve in the future in order to make any modifications or send it off to anyone that needs to see it with ease. In order to accomplish this task, we are going to click on the button in the upper left-hand corner of the screen that is labeled file. This will open up the file menu which has a number of options available. One of them will be labeled save. Click on the Save button to open up the same window where you will put the name of the file that you wish to save it and then select a location. Click on the final save button in order to save a file to your computer.

Year End Balance Sheet Template excel

you will be able to greatly enhance the bottom line of your company by making smart use of the Year End Balance Sheet Template spreadsheet. Any company that is able to try out the Year End Balance Sheet Template for at least a period of six months should see a notable increase in their bottom line. This is because it will allow you to gain a greater and deeper understanding of the financial metrics that make up the engine of your company or corporation. Ultimately having a greater depth of understanding that will allow you to exercise a greater degree of control over the future of your company.

DOWNLOAD